The European outdoor market is undergoing a period of expansion and transformation. The convergence of consumer trends, technological innovation, and shifts in sustainability is reshaping the industry. This article provides an in-depth analysis of the European outdoor market in 2025, highlighting growth by segment, leading brands, and the key trends shaping the sector.

Overview of the European Outdoor Market

According to the latest European Outdoor Group (EOG, 2025) report, the European outdoor market reached an estimated value of €21.7 billion, with an average year-over-year growth of 4.8% over the past five years. This growth has been driven primarily by the increasing adoption of outdoor activities, heightened awareness around health and well-being, and rising demand for technical and sustainable products.

Main Industry Segments

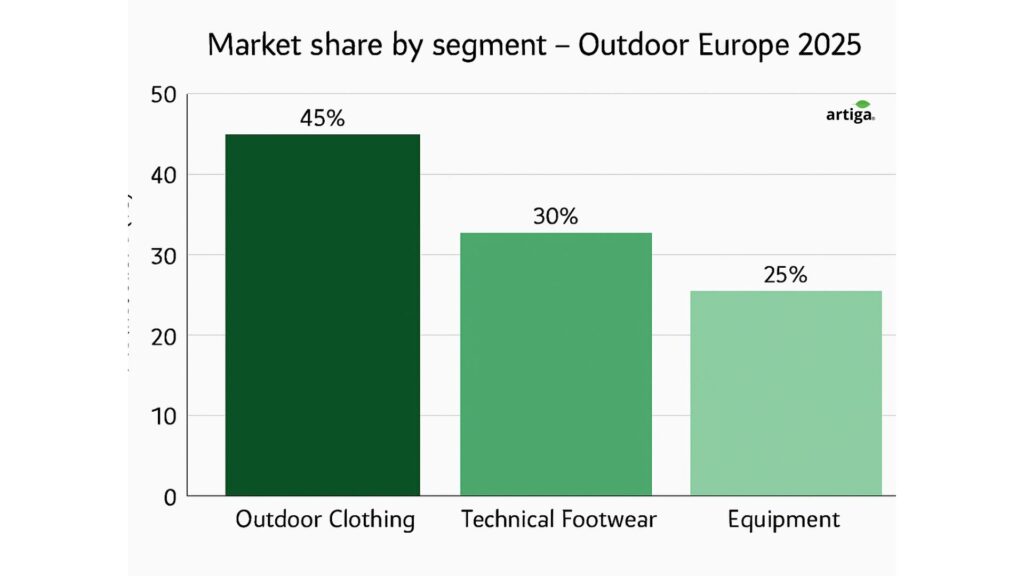

The market can be divided into three primary segments:

- Outdoor apparel: represents approximately 45% of the market, including technical jackets, softshells, waterproof garments, and high-performance mountain apparel.

- Technical footwear: accounts for nearly 30%, covering trekking boots, trail running shoes, and hybrid footwear.

- Equipment and accessories: make up the remaining 25%, including backpacks, tents, trekking poles, hydration systems, and technology devices such as GPS units and outdoor watches.

Growth and Trends by Discipline

Trail Running and Fastpacking

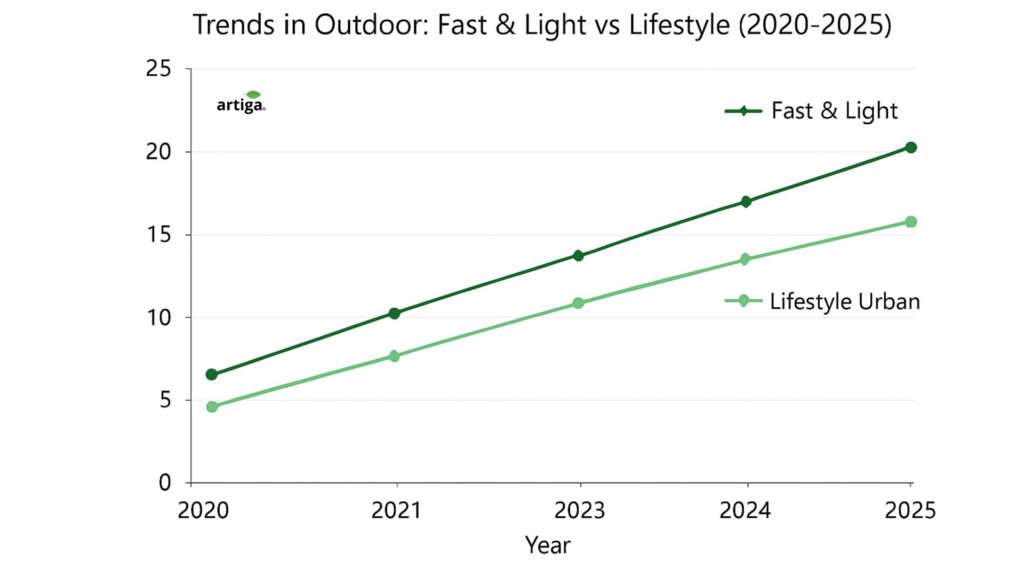

Trail running and fastpacking are the fastest-growing segments within the technical footwear and equipment categories. Consumers are seeking ultralight, high-performance products designed for fast-paced mountain activities. This trend, known as “Fast & Light,” is driving innovation in fabrics, membranes, and technical footwear.

Lifestyle and Urban-Outdoor Activities

The boundary between outdoor performance and urban fashion continues to blur. Products such as technical jackets with an urban aesthetic and hybrid sneakers appeal both to mountain enthusiasts and to consumers looking for comfort and style in urban environments. This phenomenon is expanding the industry’s reach and creating new opportunities for both established and emerging brands.

Leading Brands and Market Share

In Europe, several brands dominate the outdoor industry, standing out both in volume and innovation:

- The North Face: 12% of the technical apparel market, with a strong presence in waterproof jackets and softshells.

- Salomon: 10% in technical footwear and trail running, with a focus on technology and lightness.

- Patagonia: 6% of the market, a leader in sustainability and regenerative products.

- Arc’teryx and Mammut: each holding approximately 4–5%, focused on premium niches and technical alpinism.

In addition, emerging niche brands are capturing specific segments—particularly in trail running and fastpacking—where innovation in lightness and durability is a key differentiator.

Growth Drivers

Technological Innovation

The introduction of new materials, waterproof membranes, PFAS-free DWR treatments, and circular textiles is enabling brands to differentiate themselves. The integration of AI and big data into product development is optimizing design, testing, and consumer trend forecasting.

Sustainability and Environmental Awareness

European outdoor consumers are increasingly concerned about the environmental impact of their purchases. This has accelerated the adoption of certifications such as bluesign®, RDS, and recyclable or regenerative products. Brands that integrate sustainability into their core strategy are gaining a competitive advantage.

Distribution Channels and Omnichannel Strategy

Physical retail remains relevant, but omnichannel strategies have become a key success factor. Brands that combine in-store experiences with personalized online sales achieve higher customer loyalty and increased average order value. In parallel, digital marketing, micro-influencers, and social media are redefining the brand–consumer relationship.

Conclusion

The European outdoor market in 2025 is defined by solid growth, technological innovation, and environmental awareness. Technical apparel, footwear, and equipment segments each present distinct opportunities, while trends such as Fast & Light, urban-outdoor, and sustainability are reshaping the consumer experience. Brands that successfully combine innovation, omnichannel presence, and environmental commitment will be best positioned to gain market share and build long-term loyalty among European consumers.

References

- European Outdoor Group (EOG). “European Outdoor Market Report 2025.” https://www.europeanoutdoorgroup.com

- Outdoor Industry Association (OIA). “Global Outdoor Market Trends.” 2024.

- Statista. “Revenue of the European outdoor apparel market 2021–2025.” https://www.statista.com

- McKinsey & Company. “The state of outdoor and activewear 2025.” 2025.